Amazon has unveiled detailed plans and renderings for the Cascade Advanced Energy Facility, an initial 320-MW small modular reactor (SMR) complex that will serve as the first major project in its broader 5-GW nuclear partnership with advanced reactor developer X-energy, announced last year.

The project will be owned, built, and operated by Energy Northwest just north of Richland, Washington, on land adjacent to the public power entity’s 1,207-MW Columbia Generating Station, which remains the only commercial nuclear plant in the Pacific Northwest. Amazon, in an Oct. 16 blog post, said that development will initially focus on a four-unit Xe-100 reactor “pack” (320 MWe, 800 MWth), though plans envision expanding the Richland site to 12 reactors for a combined 960 MWe. “Construction is currently expected to start by the end of this decade, with operations targeted to start in the 2030s,” it said.

The announcement marks another significant step forward for X-energy, which is pursuing an 800-MWth, four-unit Long Mott Generating Station in Texas with partner Dow under the Department of Energy’s Advanced Reactor Demonstration Program (ARDP). X-energy’s Xe-100 high-temperature gas-cooled reactor (HTGR) is a helium-cooled, pebble-bed design that operates at temperatures exceeding 750C, using more than 200,000 continuously circulating graphite pebbles, each embedded with roughly 18,000 tri-structural isotropic (TRISO) fuel particles.

Amazon Vision for Its First Nuclear Power Project: A Compact SMR Campus to Power AI Growth

In its blog post, Amazon described the Cascade Advanced Energy Facility as a next-generation nuclear project that will “provide around-the-clock, safe, reliable carbon-free energy to support the energy demands of [artificial intelligence] and the digital tools that are part of our everyday lives.”

The announcement builds on Amazon’s Climate Pledge Fund investment in X-energy, which POWER first reported in October 2024, when the company outlined plans to help deploy up to 5 GW of new X-energy small modular reactor (SMR) capacity by 2039. Under that effort, Amazon committed direct capital to advance design and licensing of X-energy’s 80-MWe Xe-100 high-temperature gas-cooled reactor, support its TRISO-X fuel fabrication facility in Tennessee, and back early-stage development with Energy Northwest in Washington state.

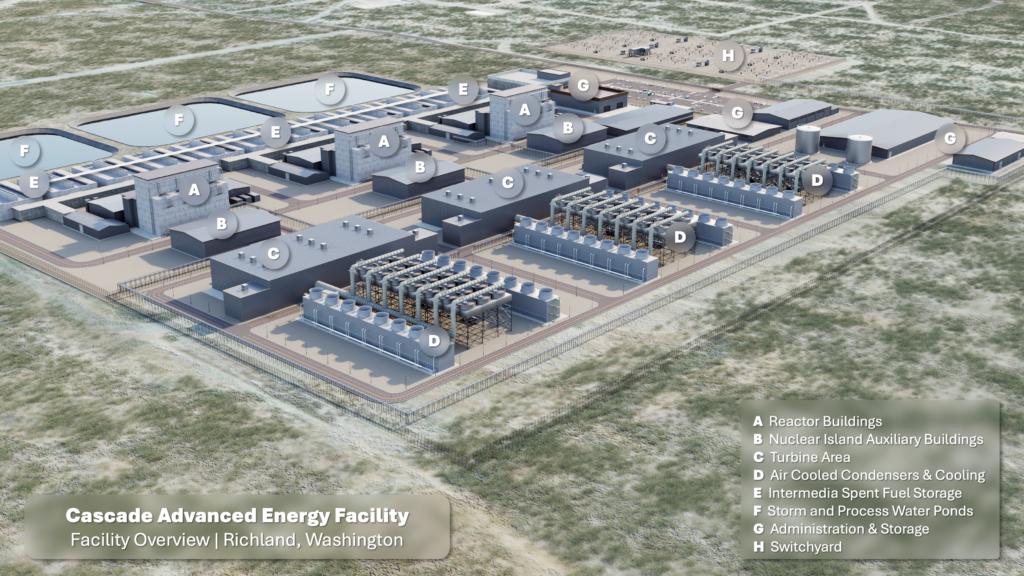

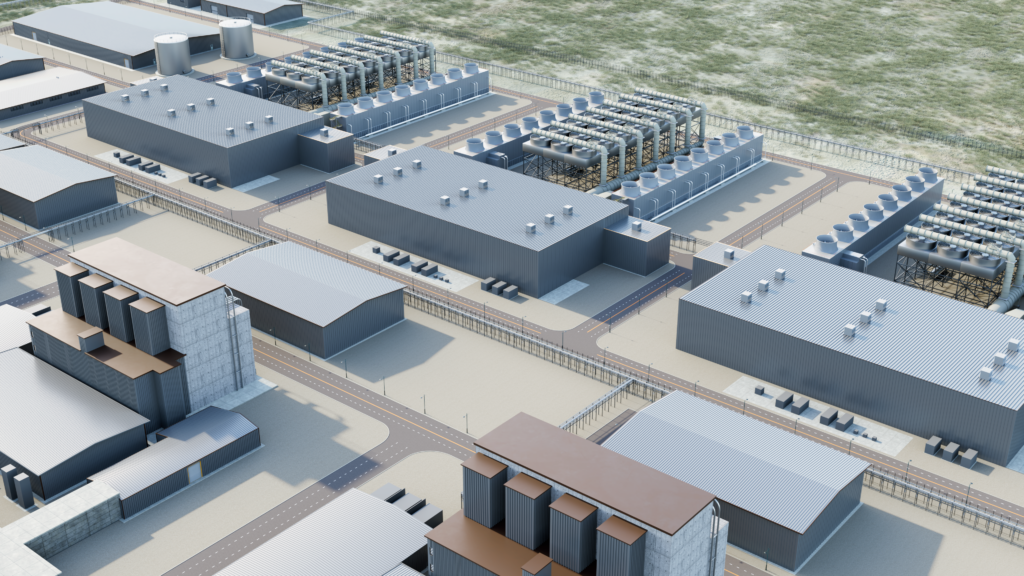

Renderings published by X-energy depict a multi-island nuclear campus organized around the Xe-100’s modular construction philosophy. The 960-MW Cascade layout is arranged in three groupings of four 80-MWe reactor units, each forming a self-contained “block” with its own reactor building, nuclear island auxiliaries, and turbine area, paired with air-cooled condensers and a compact network of electrical and service systems. Supporting infrastructure—including helium service, spent-fuel storage, and storm and process water ponds—is repeated in standardized configurations to streamline construction and facilitate replication at future sites.

While the overall complex will be capable of producing nearly 1 GW of electricity when fully built out, it will occupy only “a few city blocks”—“a stark contrast to traditional nuclear power facilities whose single GW plant can take up more than a square mile of land,” Amazon noted.

Amazon and X-energy’s visual materials also highlight an advanced digital control architecture featuring two simulator environments. One is designed as an educational training facility at Columbia Basin College, and the other will serve as X-energy’s full-scale control room prototype for design verification. Both will employ fully digital human–machine interfaces with multi-screen configurations that allow operators to monitor each Xe-100 reactor module in real time. The classroom simulator, modeled after X-energy’s control room and housed in space donated by Washington State University Tri-Cities, is expected to be operational later this year.

The Cascade facility is expected to generate more than 1,000 construction jobs and over 100 permanent positions in nuclear operations, engineering, and related technical fields, Amazon said, noting the project will serve as both a regional economic driver and a workforce development catalyst for the Pacific Northwest. “Investing in advanced training simulators prepares future operators and builds the foundation for a clean energy workforce that will power our region for decades to come,” said Bob Schuetz, CEO of Energy Northwest. “This interactive experience helps demystify nuclear energy and goes beyond the textbook, showing students that a viable, meaningful career in clean energy is within reach—and that they can be part of something transformative.”

Both Amazon and X-energy, however, noted that the Cascade will represent a new model for public-private collaboration in deploying advanced nuclear technology at grid scale. “This project isn’t just about new technology; it’s about creating a reliable source of carbon-free energy that will support our growing digital world,” said Kara Hurst, Amazon’s chief sustainability officer. “I’m excited about the potential of SMRs and the positive impact they will have on both the environment and local communities.”

X-energy CEO J. Clay Sell underscored the Cascade initiative’s “historic” scale. “The support of Amazon has enabled us to grow our team with world-class talent and position the Cascade Advanced Energy Center at the forefront of energy innovation,” he said. “We are privileged to have world-class partners like Amazon and Energy Northwest in this effort.”

A Race to Secure Nuclear Megawatts for AI-Era Power Demands

Amazon’s efforts to support a 5-GW nuclear pipeline, announced a year ago, remain noteworthy, even as hyperscalers have since intensified a scramble to secure reliable long-term baseload power for their surging AI workloads.

Amazon set the pace in March 2024 when it bought Talen Energy’s Cumulus data center adjacent to the 2.5-GW Susquehanna nuclear plant in Pennsylvania to pursue a co-located model. But that effort was stymied in November 2024, when the Federal Energy Regulatory Commission (FERC) rejected a proposed PJM amendment to expand the site’s behind-the-meter interconnection, citing fairness and cost-allocation concerns. Rather than appeal the decision, Amazon and Talen restructured the arrangement under a retail delivery model and, in June 2025, announced a 17-year, $18 billion front-of-the-meter power purchase agreement (PPA) that designates Talen as AWS’s licensed retail electricity provider in Pennsylvania. Under the contract, deliveries are slated to reach between 840 MW and 1,200 MW by 2029, and between 1,680 MW and 1,920 MW by 2032, depending on AWS’s development pace.

In September 2024, Microsoft inked a 20-year PPA to restart Constellation Energy’s Three Mile Island Unit 1 reactor (Crane Energy Center) to secure 837 MWe exclusively for Pennsylvania data centers, and it has moved up its restart date to 2027. In October 2024, Google reserved future SMR capacity through a 500 MW PPA with Kairos Power for its Tennessee campus and later committed early-stage capital toward 1.8 GW of advanced reactors via Elementl Energy. That same month, Amazon announced it would back the deployment of 5 GW of new X-energy SMR projects by 2039, starting with an initial four-unit 320-MWe Xe-100 plant with Energy Northwest in central Washington. Amazon, notably, also partnered with Dominion Energy to explore SMR development near Virginia’s North Anna nuclear station, targeting at least 300 MWe of additional capacity.

In more recent deals, Constellation in June 2025 finalized a 20-year PPA guaranteeing Meta’s offtake of the Clinton Nuclear Power Plant’s entire 1,121 MWe output beginning in 2027. The agreement, which includes a 30-MWe uprate to be completed in 2029, ensures continued operations at the Illinois facility after the state’s zero-emission credit program expires in 2027. Constellation has said the long-term certainty provided by the Meta contract has enabled it to begin evaluating regulatory pathways to deploy additional nuclear capacity at the site, including potential advanced or small modular reactors under an extended or renewed Early Site Permit.

Amazon’s Power Procurement Challenge

For Amazon, nuclear investments forge a pathway to stable, clean power with which it can meet its goals. “We remain committed to developing the energy infrastructure needed to meet the growing power needed to support the advanced technology we depend on—from smart appliances to mobile devices and AI tools,” the company said in its blog post Thursday. “For local communities in Washington state, this power generation project represents not just a new source of carbon-free energy for the grid, but also economic opportunity—creating jobs, expanding the tax base, and solidifying a leading role in the development of advanced nuclear technology.”

During the company’s latest (July 31, 2025) earnings call, Amazon CEO Andy Jassy acknowledged that AWS has “more demand than we have capacity right now” and that “we could be doing more revenue and helping customers more” if not for infrastructure limitations. Pressed by analysts, Jassy identified power availability as “the single biggest constraint.” However, the company’s escalating electricity demand—which some analysts project could require up to $150 billion in infrastructure investment over the next 15 years—has drawn investor scrutiny. In its May 2025 proxy statement, Amazon’s board opposed a shareholder proposal, which sought greater transparency on how the company would meet Climate Pledge commitments amid “massively growing energy demand from artificial intelligence.”

Amazon’s Climate Pledge, which aims to reach net-zero carbon emissions by 2040, unites more than 550 signatories across 55 industries to accelerate joint action on climate solutions. Its Climate Pledge Fund—a $2 billion venture investment program—supports technologies that advance sustainability and carbon-free energy, including investments in wind, solar, battery storage, and new SMR projects to power its operations and add clean generation to the grid.

The shareholder proposal cited concerns that “data center power demand may more than double, from 1-2% of global power now to 3-4% by 2030.” Amazon’s board response reaffirmed a strategy to “diversify our energy portfolio with additional reliable carbon-free sources of energy, like nuclear power,” citing its 2024 SMR agreements as part of the $2 billion Climate Pledge Fund initiative targeting “hard-to-abate sectors.” SMRs have “a smaller physical footprint, allowing them to be built closer to the grid” and “faster build times than traditional reactors, allowing them to come online sooner,” the proxy notes, though it acknowledges they will not deliver power until the early 2030s.

The proxy also details Amazon’s efforts to boost data center efficiency, noting that AWS achieved a global power usage effectiveness (PUE) rating of 1.15 in 2023 (its best-performing site reached 1.04). Amazon said purpose-built silicon such as its AWS Trainium and Inferentia chips are designed to deliver higher throughput than comparable accelerated compute instances while reducing the carbon footprint per workload and improving performance per watt. Notably, the company pointed to new data center components announced in December 2024 that will provide 12% more compute power per site and incorporate advanced cooling systems that are expected to cut its mechanical energy consumption by up to 46% during peak conditions.

A Shining Prospect for Energy Northwest

For Energy Northwest, a Washington state public power joint operating agency whose membership comprises 29 public power utilities, the Cascade facility will build on more than four decades of operating Columbia Generating Station, which has delivered 1,207 MW of carbon-free baseload power since 1984.

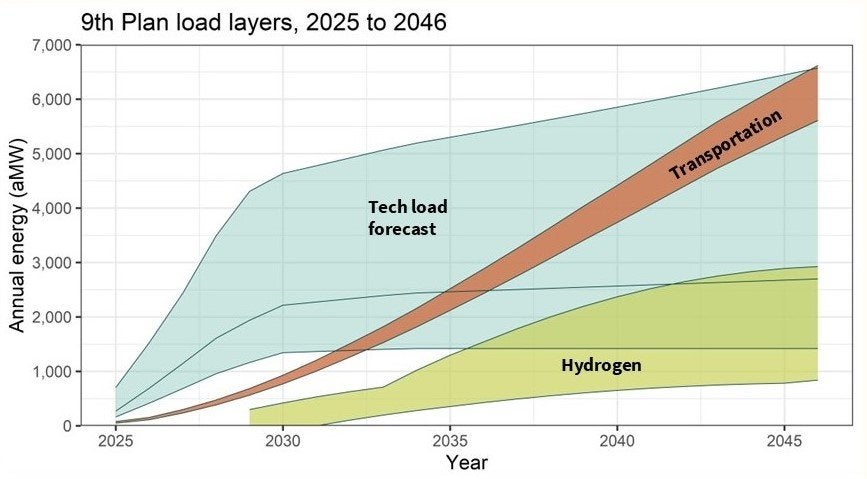

Cascade’s unveiling comes as the Pacific Northwest enters a period of rapid electricity demand growth. The Northwest Power and Conservation Council’s 2025 forecast projects a surge in regional power consumption, from about 22,000 average MW (aMW) today to between 31,000 and 44,000 aMW by 2046, and it suggests peak loads could reach 60,000 MW. While the bulk of the increase is expected from data centers, semiconductor manufacturing, transportation electrification, and hydrogen production, the council notes power grids in the Northwest “are encountering significant challenges with transmission system constraints, supply chain delays and issues, and interconnection queue backlogs.”

Energy Northwest began exploring SMR options after the passage of Washington State’s Clean Energy Transformation Act in 2019, which requires a greenhouse gas–free electric supply by 2045. In 2020, shortly after the DOE unveiled X-energy and TerraPower as winners for the ARDP program, X-energy revealed discussions with Energy Northwest under a cooperative agreement for a preferred site near the Columbia nuclear power plant, positioning Energy Northwest as the federal demonstration project’s owner-operator. However, following a joint development agreement with Dow in May 2023, X-energy announced it would move the Xe-100 demonstration to a Dow site, and the Long Mott Generating Station, a four-module (800 MWth/320 MWe) station, is now taking shape in Calhoun County, Texas. In June 2025, the NRC announced an 18-month timeline to complete environmental and safety reviews for Dow and X-energy’s Xe-100 Construction Permit Application. The site is expected to be the first grid-scale advanced nuclear reactor project deployed to serve an industrial site in North America.

X-energy, meanwhile, first announced a joint development agreement for up to 12 modules with Energy Northwest for an SMR in July 2023, laying out the scope, location, and schedule for the project. Amazon joined the partnership last year (October 2024), agreeing to fund the initial feasibility phase for the Washington State SMR project. As part of that agreement, notably, Amazon holds the right to purchase power from Cascade’s first four-module 320-MWe project.

Energy Northwest says that since its 2024 agreement with Amazon, it has “focused on engagement with stakeholders and Tribal Nations, conducting environmental reviews, safety evaluations, permitting, licensing, and risk analyses to prepare for a construction permit application to the U.S. Nuclear Regulatory Commission.” In December 2024, the entity selected AtkinsRéalis—the original equipment manufacturer and global steward of CANDU nuclear technology with extensive SMR licensing expertise—as the project’s technical advisor to support design, licensing, and regulatory strategy.

“Today marks a pivotal step forward in bringing this transformative project to life,” said Bob Schuetz, CEO of Energy Northwest, on Thursday. “We are proud to be at the forefront of deploying advanced nuclear technology in the region—driving next-generation solutions that strengthen energy security and position the Pacific Northwest as a clean energy leader.”

Commercial Momentum Builds as X-energy Advances Fuel Supply, Licensing, and Global Partnerships

So far, X-energy has advanced multiple fronts of its commercialization strategy over the past two years, and the Cascade facility is poised to come online as its second U.S. flagship project, following Dow’s ARDP Seadrift project. X-energy is also making tangible progress for its TRISO-X fuel fabrication facility (TX-1) in Oak Ridge, Tennessee—a facility slated to become the first commercial-scale TRISO fuel manufacturing plant in North America and potentially the first Category 2 fuel fabrication facility licensed by the NRC. For now, TRISO-X anticipates NRC regulatory approval by May 2026.

A wholly-owned X-energy subsidiary, TRISO-X has been developing its proprietary tri-structural isotropic (TRISO) particle fuel since operating a pilot facility at Oak Ridge National Laboratory starting in 2016. The facility will refine a patented fabrication process for pebble-bed reactor applications. Particles consist of uranium kernels coated in multiple layers of silicon carbide and pyrolytic carbon designed to contain fission products at temperatures exceeding 1,600C—far beyond any accident scenario.

X-energy in August 2025 awarded Clark Construction Group a $48.2 million contract for Phase 2A construction of the TX-1 facility, a 214,812-square-foot plant, which will be capable of producing five metric tons of uranium or 700,000 TRISO pebbles annually—“enough fuel for up to 11 Xe-100 reactors,” it notes. The facility—which received a $148.5 million investment tax credit under the Inflation Reduction Act in 2024—completed site preparation work, spearheaded by Geiger Brothers, in July 2025. Core construction is now underway. Meanwhile, the Department of Energy additionally authorized approximately $30 million for early procurement of critical long-lead equipment. And in April 2025, TRISO-X received the first allocation of high-assay low-enriched uranium (HALEU) from the DOE’s HALEU Allocation Program, potentially securing fuel feedstock for the initial core loads of at least the Texas project.

The Cascade facility will also leverage an August 2025 collaboration announced by X-energy, Amazon, Korea Hydro & Nuclear Power (KHNP), and Doosan Enerbility, which have set out to scale Xe-100 production and deployment. The alliance—which aligns with the $350 billion U.S.–Republic of Korea trade framework—has committed to mobilizing as much as $50 billion in public and private investment to accelerate Amazon’s 5-GW U.S. pipeline of advanced nuclear projects serving data-center, industrial, and electrification demand. Under the agreement, KHNP and Doosan will supply manufacturing and construction expertise from South Korea’s established nuclear supply chain and strengthen component fabrication capacity for future Xe-100 modules.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).